Bear Capital Partners (BCP) was formed to meet the current needs of the Multi-Family real estate market. Ronald L. Meer was appointed President because his guidance and leadership has previously led to significant value appreciation for his investors as a result of:

1. Successful rehabs of tired or poorly functioning properties

2. Re-positioning of inadequately or incorrectly marketed properties

3. Acquisition of properties which represented excellent prospects for value creation and

4. New construction/development opportunities utilizing proven unique product designs in markets with pent up demand for new multi-family properties.

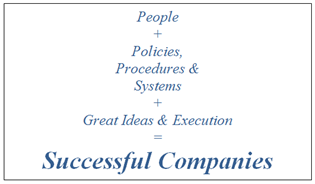

BCP’s motto is best expressed through the following formula:

Ron Meer has been successful because he believes in the ever ending need for strong Multi-Family assets in the portfolio of his investors. Throughout his career, Ron has served his investors well by applying the aforementioned formula for success, hard work and the ability to put strong work teams together in design, marketing, property management, construction and finance. Such teams represent a blend of inside employees, outside contracted professionals and talented subcontractors/vendors. Moreover, his teams are always anchored with strong marketing, exceptional operational and strategically focused staff, who think ‘outside the box’.

"There is one thing that is a certainty about investing in Real Estate,” according to Ron. “When you look at the increases in population in the United States due to a higher birth rate than the current death rate, the influx of new citizens from immigration and because of a very difficult SFH lender environment, there is a ton of pent up demand."

The demand for Multi-Family product by consumers will not be satisfied for years to come and this is acutely true in markets where there is job creation or job migration taking place.” As the population changes to follow the job migration, to look for lower priced housing or to seek a lifestyle away from the social problems, we will be there to meet the need for new housing opportunities for potential residents.

While there was significant overbuilding of Retail and Single Family Residential properties in 2003 through 2007, and again perhaps in 2012 and 2013, Multi-Family real estate remains at historically high occupancies. Moreover, many rental opportunities which heretofore had not been seen in the marketplace, revealed themselves during the past two years due to the large addition changes made by portfolio owners and, in certain markets, special servicers. Most of this inventory has been foreclosed and resold in most markets. As families displaced by the foreclosure process and the difficulty of new loan qualification look for housing, apartment rental properties have become their short term focus to house their families. Multi-Family apartment communities where there are superior amenities and facilities to support their families have become their preferred and the most commonly accepted solution to their housing displacement.

The obvious trend in 1998 through 2002 cannot be ignored and this trend appears to be poised to repeat itself. Housing starts for apartment homes are surging yet there just isn't enough new product coming online to meet the demand for new housing just from the birth rate and foreclosure issues alone.

Whether you are a Multi-Family Property Owner, Investor or Vendor looking to find a successful team to work with in providing the products provided by our Company, Bear Capital Partners represents an excellent choice to meet your needs.